Table of Content

Finally, it’s value pointing out that New York tax liens don’t final eternally. They fall off with the passage of time, if the State is unable to gather inside 20 years. That is, New York tax liens have a20 yr statute of limitations).

That is, at least in the sense that it represents authorized motion taken by the State to resolve a difficulty. However, in distinction to an arrest warrant, a tax warrant does not give the State the ability to bodily detain you. Rather, it instead gives the State the ability to takecertain assortment actionsagainst your property.

What Is A Tax Warrant In Ny? The Way To Resolve New York Tax Liens

Requestors might run a free title search, but this could be very time-consuming, so it's best to go to a title company or rent a personal title agent and have an intensive seek for a lien on the property . When a New York City property has tax arrears, it might be subject to enforcement actions by the town to gather the quantities due. Under certain circumstances, New York State may grant you a release of lien or subordination of lien if you are unable to pay your warranted stability in full. Check that the property's excellent tax assessments are absolutely paid before making use of for a launch of lien.

These debtors normally don't work with us to resolve their debt, and don't have earnings or different assets we can seek to recuperate by assortment enforcement. The quantity of each warrant is the quantity due and owed after we filed the warrant. The current amount due could also be larger or decrease, relying on the accrual of penalties and curiosity, changes to the evaluation amount, or subsequent payments. Satisfaction of Judgmentif the warrant satisfaction has been filed with the county clerk.

What's A Mechanics Lien In New York?

A mortgage is a voluntary lien that grants a mortgagee a legal declare to the mortgagor's actual property. Mortgages are loans that assist mortgagors finance home possession; the mortgagor does not have full ownership of the property till the mortgagor has accomplished the mortgage cost. Additionally, the property is collateral; therefore, the mortgagee may repossess the house if the mortgagor misses mortgage payments.

The launch of lien is an authorization to switch the real property, positioned in New York State, free and away from the property tax lien. The lien applies only to actual property situated in New York State. As the saying goes, an oz. of prevention is worth a pound of remedy. If you obtain a discover of deficiency or willpower, there are a quantity of issues you can do to assist yourself.

In Case You Are Requesting A Subordination Of Lien

If the taxpayer needs prolonged time to pay off their debt, we might file a warrant to guard New York State’s interests until the liability may be fully paid. While common liens apply to all of a debtor's non-exempt assets, particular liens apply to a debtor's particular asset. With a common lien, a creditor may take possession of as many belongings as is needed to make up the value of the debt.

If the debtor has difficulty paying debt off in time, they may negotiate with the creditor. Involuntary liens exist where a formal agreement between the creditor and debtor was not issued. In distinction, general liens exist where no particular asset was attached to the contract as collateral. On the opposite hand, a mortgage lien is both voluntary and particular. Voluntary liens exist where there was a proper settlement between the creditor and debtor .

Check your payment balance, file a return, make a payment, or respond to a department notice—anywhere, anytime. The size of time a lien stays on a property varies with the type of lien. Other than tax and mortgage liens which remain till the debt is paid, most liens last for ten years or till the debt is happy, as within the case of negotiation between debtor and creditor. Go to the public recorder's workplace and observe the aforementioned details, together with any current lawsuits towards the property. A creditor has the best to file a lien in opposition to a debtor's property as security for the debtor's obligation.

If we do not have the right kind and fee to document your lien, we are going to contact you to let you know what is required. Thank you dearly for taking the time to go through in great element options for our situation. You have been affected person, thorough and very useful even after you knew we were unable presently to pay for services. I wish other corporations would follow your stage of customer support. Here are some answers to generally requested questions we hear from purchasers who're apprehensive about an NYS tax warrant. Every County in New York State handles tax lien foreclosures in several ways.

Launch Or Subordination Of Lien

Scan and upload your completed form at our Customer Self-Service Center. Your payment has posted to our system and you supply proof showing the payment has cleared your account. Include all other supplemental documents (see Form ET-706-I, Instructions for Form ET-706). If you wish to designate a representative to receive confidential info in your behalf, see Form ET-14, Estate Tax Power of Attorney. By clicking "I Agree," you consent to our Terms of Use and are authorizing Staterecords.org to conduct a individuals analysis to identify preliminary outcomes of the search topic you entered. You perceive and agree that search stories will only be available with a purchase order.

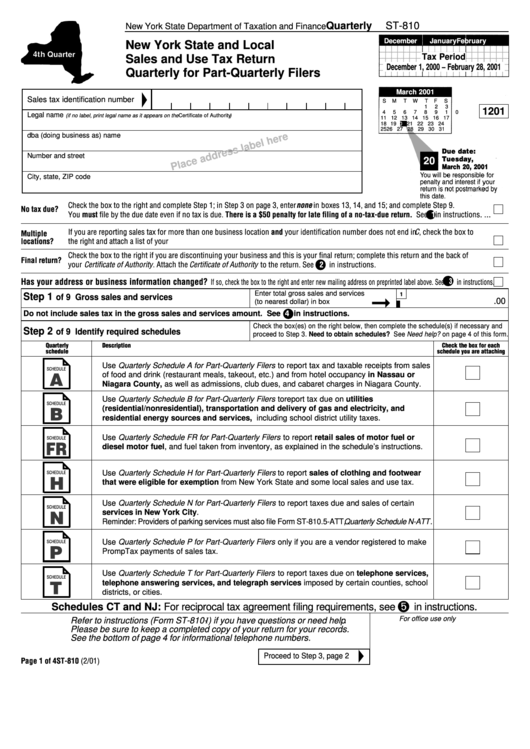

Please don't embody any confidential information in this type. This kind sends info by non-encrypted e-mail which is not secure. The lately enacted New York State finances suspended sure taxes on motor gas and diesel motor gasoline effective June 1, 2022. If you are a motor carrier, renew your credentials and pay your renewal fees online with One Stop Credentialing and Registration . The Department of Finance has made the data for all NYC properties out there on the NYC Open Data portal for obtain. You can obtain a Property Tax Payment Agreement Request kind from our web site.

When the New York tax division issues a warrant, it goes to the county clerk’s workplace in any county where you own property, and it also goes to the NY Department of State. The home-owner tax rebate credit score is a one-year program providing direct property tax reduction to eligible homeowners in 2022. The proceeds from the sale is not going to be sufficient to pay your warranted steadiness in full. A release of lienis a document that releases New York State’s curiosity in a specific piece of property so it may be transferred to a new proprietor.

A tax lien is a authorized declare towards real property for unpaid municipal costs, corresponding to property taxes, housing upkeep, water, sewer, demolition, and so on. An proprietor whose property is topic to a tax lien sale will obtain a lien sale discover and the lien sale list will be revealed publicly. In a tax lien sale, the City sells delinquent liens to a single licensed buyer, who does not take title to the property, but does buy the proper to collect the money owed plus interest and costs. Ultimately, if the property owner does not pay, the lien holder may foreclose and the building might be bought at auction. Persons who default on property tax funds, together with utility payments similar to water bills, interests, and different charges, might lose the property to foreclosure. The state or federal tax authority information a lien towards property tax delinquents, which in flip may initiate a foreclosures.

No comments:

Post a Comment