Table of Content

It will also send out several notices relating to the deficiency to the taxpayer. In this article, we will talk about the different steps for a taxpayer to keep away from having a tax warrant issued. We’ll also go over the different options taxpayers need to take away a tax lien once it’s imposed by New York. As might be shown, New York tax liens are nothing to take flippantly. Nonetheless, if a taxpayer makes the effort and seek the assistance of with a certified tax professional, a bad tax state of affairs can enhance. In New York, laborers, contractors, sub-contractors, design professionals, materials suppliers, design professionals, and equipment lessors may file a mechanics lien in opposition to a debtor.

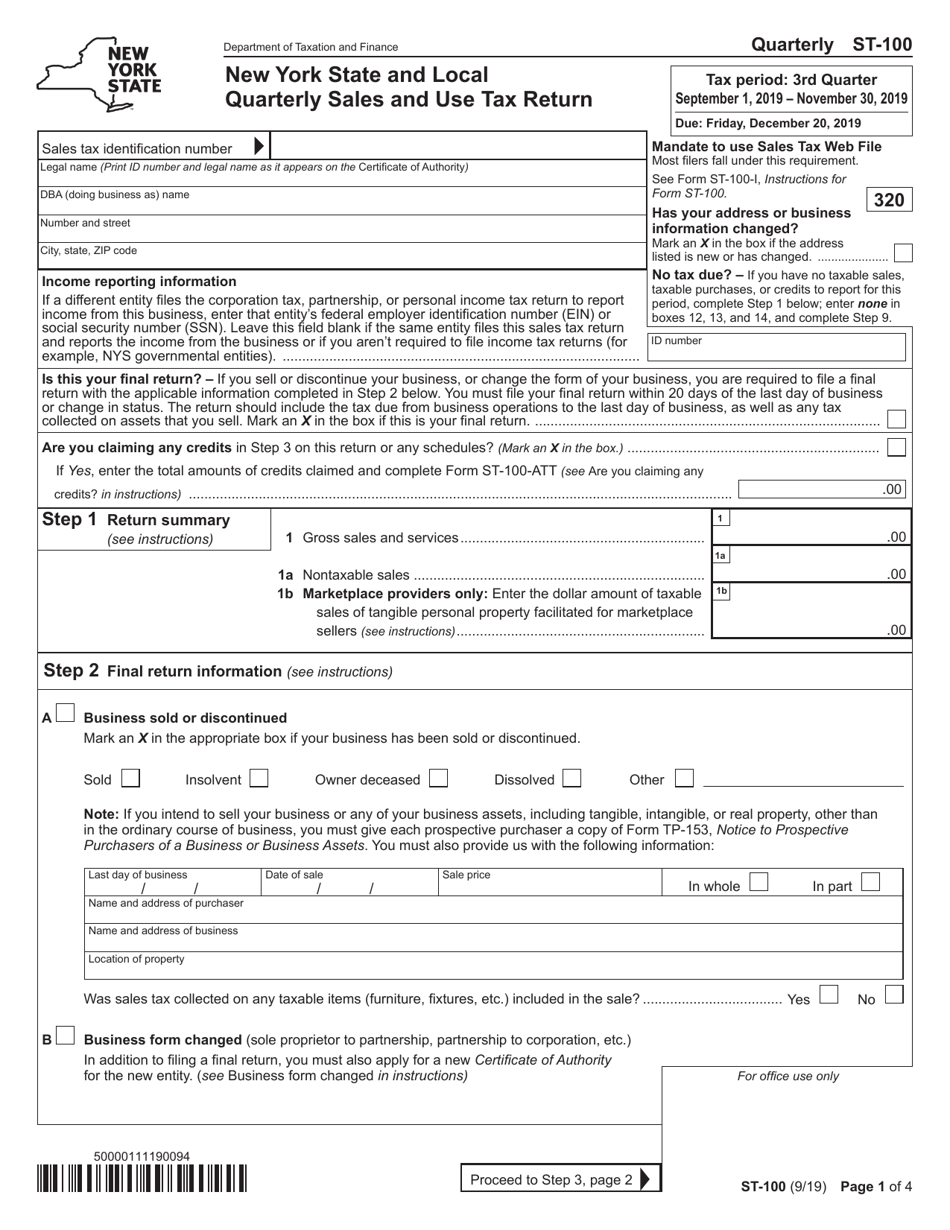

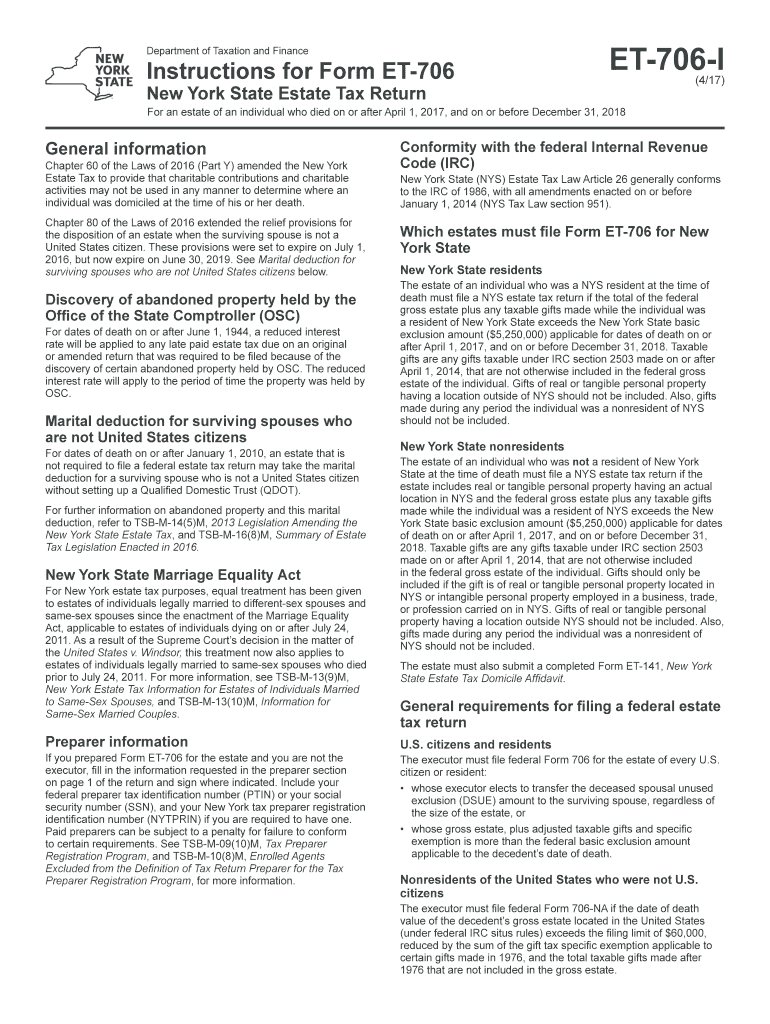

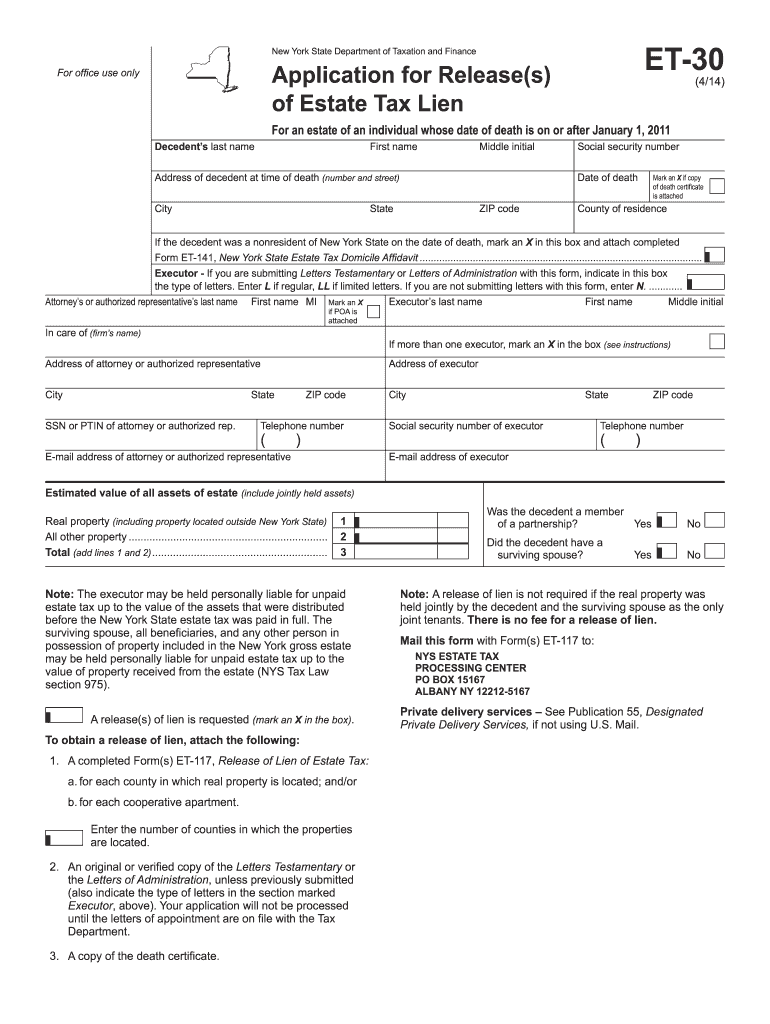

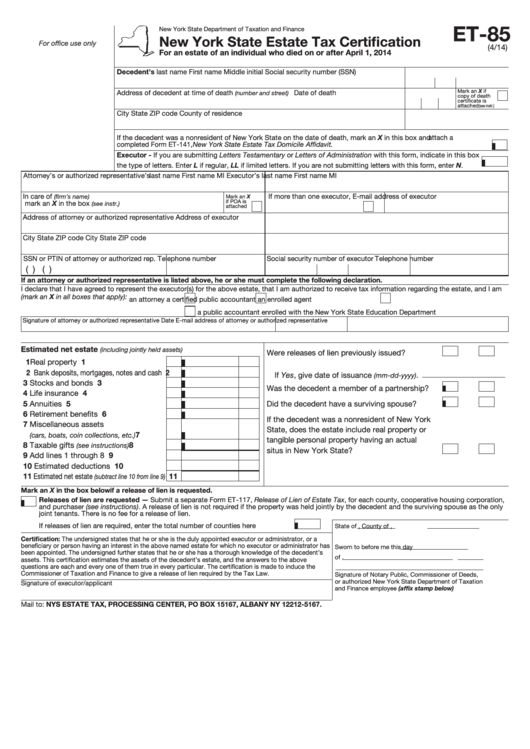

If you have not filed and paid your tax, use our penalty and interest calculator to calculate your late filing and late cost penalties and curiosity. Use the property's recorded deed and property tax bill to complete all sections of Form ET-117. File a separate Form ET-117 for properties located in different counties. Parties must enforce new York mechanics liens inside one 12 months of filing. Once the warrant has been filed, it's going to live on no matter where you reside.

Lien Sales

Another advantage is that lots of the properties offered at a tax lien auction are vacant or commercial items, highly desired by buyers. The NYCTL Trusts, in flip, rent servicers to collect the outstanding tax lien from the property owner/delinquent taxpayer . We provide numerous on-line providers to match your busy lifestyle.

If the taxpayer wants extended time to pay off their debt, we might file a warrant to guard New York State’s pursuits until the liability can be totally paid. While general liens apply to all of a debtor's non-exempt property, particular liens apply to a debtor's particular asset. With a basic lien, a creditor could take possession of as many belongings as is required to make up the worth of the debt.

What If I Ignore A Ny Tax Warrant?

Unlike other kinds of property liens, mortgages are voluntary. If you've a tax warrant issued against you, you probably can take away it by satisfying the debt. You can even take away it by efficiently challenging the validity of the warrant. You also can defeat it by exhibiting that the underlying liability is incorrectly assessed.

We may have filed the warrants over a interval of years, but we filed at least one warrant inside the last 12 months. The debtors are ranked by the total docketed value of their warrants. If you fail to well timed resolve your tax debt, your late tax debt becomes fixed and last and we could file a tax warrant against you.

Department Of Motor Vehicles

We will only grant your request for a release of lien or subordination of lien whether it is in the most effective interest of New York State. File a separate Form ET-117 for actual property and cooperative flats, even when they are positioned in the same county. Whether or not a launch of lien is required doesn't depend upon the worth of the property. Liens could additionally be filed by chance, so lienees shall be required to certify the error, contact the lienor to fix it, or take it to courtroom and dispute it if the lienor doesn't comply.

NewYork.StateRecords.org is not a shopper reporting agency as defined by the Fair Credit Reporting Act (“FCRA”). You perceive and acknowledge that these stories are NOT “consumer reports” as defined by the FCRA. The service doesn't show any personal information about the automobile owner or registrant. In response to persevering with financial impairments ensuing from the spread of the coronavirus, the OAG will renew orders Sept. 5 via Sunday, Oct. four. After this period, the OAG will reassess the wants of state residents for one more attainable extension.

Division Of Taxation And Finance

Then we should retrieve and evaluation the application types to discover out the suitable response. A tax warrant can damage you financially, however you've choices. When you contact us, we might help you find the most effective tax reduction possibility for your New York and IRS tax money owed. We have worked with many glad purchasers up to now, and we would love to help you. In this case, you have to contact New York State and ask if they will subordinate the mortgage.

If the debtor has issue paying debt off in time, they might negotiate with the creditor. Involuntary liens exist where a proper settlement between the creditor and debtor was not issued. In distinction, basic liens exist the place no explicit asset was hooked up to the contract as collateral. On the opposite hand, a mortgage lien is both voluntary and specific. Voluntary liens exist the place there was a proper agreement between the creditor and debtor .

How Do You Know If A Property Has A Lien In New York?

Scan and addContent your completed form at our Customer Self-Service Center. Your payment has posted to our system and also you provide proof showing the payment has cleared your account. Include all different supplemental paperwork (see Form ET-706-I, Instructions for Form ET-706). If you wish to designate a representative to obtain confidential information in your behalf, see Form ET-14, Estate Tax Power of Attorney. By clicking "I Agree," you consent to our Terms of Use and are authorizing Staterecords.org to conduct a individuals research to identify preliminary outcomes of the search topic you entered. You understand and agree that search reports will solely be obtainable with a purchase.

Once the State sends this preliminary notice, you ought to have ninety days to deal with your tax account. Additionally, a tax warrant makes it very onerous to promote or borrow in opposition to your belongings. The Tax Department doesn't file warrants for all mounted and final tax debt. We may chorus from filing a warrant if we're working with the taxpayer to resolve fee of their debt.

If somebody refers to your warrant using the phrase “New York tax liens,” they are talking about the same factor. Most of the correspondence from the NYS DTF will say tax warrants quite than tax liens. The New York Department of Taxation and Finance can file a tax warrant towards you when you have delinquent income tax, sales tax, or different New York State taxes. This is the primary assortment motion taken by the state, and it creates the authorized pathway for the NYS DTF to seize your wages, bank accounts, and property. "As the financial impacts of COVID-19 rage on, the tax lien sale places an pointless financial burden on New York's homeowners, and particularly communities of shade," James noted.

The lien offers the creditor a legal claim on the debtor's property; the creditor could foreclose or sell the debtor's property for the value of the debtor's obligation. Timothy S Hart, the founding associate of the tax legislation agency of Timothy S. Hart Law Group, P.C. Ignoring your NYS tax debt opens the door to many potential points, together with tax warrants, asset seizures, and wage garnishments. At this level, you've a really limited period of time to pay the taxes before the state pursues additional assortment actions against you. This could embody wage garnishment, seizing your financial institution or retirement accounts, or taking your assets.

No comments:

Post a Comment